new mexico gross receipts tax rate

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. Imposition and rate of tax.

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Tax Fraud in New Mexico call 1-800-457-6789.

. 6 - Form TRD-41413 Gross Re-ceipts Tax Return and Schedule A 1 - Form 41413 Gross Receipts Tax Business-Related Tax Credit Sched-ule CR and Supplemental Schedule CR GRT payment voucher instructions and 7-GRT-PV. Pay Parking Citations Excavation Barricade Permits Health Permit Renewal Alarm Fees. State of New Mexico Gross Receipts Tax Rates.

Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest. Starting July 1 those businesses will pay both the statewide rate and local-option Gross Receipts Taxes. Since 2019 internet sales have been taxed using the statewide 5125 rate.

NTTCs may be required to support tax-deductable sales. The table below shows state county and city rates in every county in New Mexico as well as some of the largest cities. The proposal would trim New Mexico s gross receipts tax rate by 025 putting the rate at under 5.

Texas Margin Tax allows for a choice of deducting compensation or the cost of goods sold. Liquor Pawnbroker License Holders. Click here for a larger sales tax map or here for a sales tax table.

The statewide gross receipts tax rate is 5125 while city and county taxes can add up to a total of 4125. A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form 1106. Pawn Second Hand Precious Metal Dealers Permits.

The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. Listing Agreement Exclusive Right to Sell for the listing REALTOR to fill in so that the proper amount of Gross Receipts Tax is computed and collected by the title company. Submit Current Contact Information.

Gross Receipts Tax Rate Schedule. The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375. Use a Tax Rate Table.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. In general the gross receipts tax rate is origin-based determined by the business location of the seller or lessor not the location of the. Among the proposals is one to trim the statewide gross receipts tax.

353 rows New Mexico has state sales tax of 5125 and allows local governments to collect a local option sales tax of up to 7125There are a total of 134 local tax jurisdictions across the state collecting an average local tax of 2257. Nevada allows a firm to deduct 50 percent of its Commerce Tax liability over. Cutting gross receipts taxes for the first time in decades will put more money in the pockets of New Mexico families and.

And 12 New Mexico Taxpayer Bill of Rights. Ohio and Oregon have flat rates of 026 percent and 057 percent respectively. For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is imposed on any person engaging in business in New Mexico.

The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent. The governors office said the. Although the Gross Receipts Tax is imposed on businesses it is common for a business to pass the Gross Receipts Tax on to the purchaser either by separately stating it on the invoice or by combining the tax with the selling price.

The tax imposed by this section shall be referred to as the gross receipts tax. The Gross Receipts map below will operate directly from this web page but may also be launched from the Departments Web Map Portal portal link located below the map. The changes to the GRT came primarily in response to the US.

Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes. Denomination as gross receipts tax. Supreme Court decision in South Dakota v.

Only in its effect on the buyer does the gross receipts tax resemble a sales tax. The gross receipts tax rate varies throughout the state from 5125 to 88675 depending on the location of the business. New Mexico Gross Receipts Quick Find is available.

Combined with the state sales tax the highest sales tax rate in New Mexico is. Of that amount 5125 is the rate set by the stateGross Receipts Tax Rate. Gross receipts tax rates are subject to change in January and July.

This would be the first change in New Mexicos gross receipts tax rate since July 2010 when the rate increased from 5 to 5125. 10 Your Rights Under the Tax Law. Anything over 5125 percent represents local option rates imposed by counties and municipalities.

On April 4 2019 New Mexico Gov. Most New Mexico -based businesses starting July 1 must now also use destination sourcing. Lujan Grisham a Democrat has proposed some tax breaks as she seeks reelection.

The tax base and allowable expenditures vary depending on the design of the gross receipts tax. There are a few ways to determine the proper location code. View the current Gross Receipts Tax Rate Schedule.

How to use the map. What is the New Mexico gross receipts tax. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0 to 9062 across the state with an average local tax of 2257 for a total of 7382 when combined with the state sales tax.

Update your tax records online. The maximum local tax rate allowed by New. This year New Mexico again is awash in money.

The business pays the total gross receipts tax to the state which then. New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933.

Business Guide To Sales Tax In New Mexico

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

New Mexico Sales Tax Small Business Guide Truic

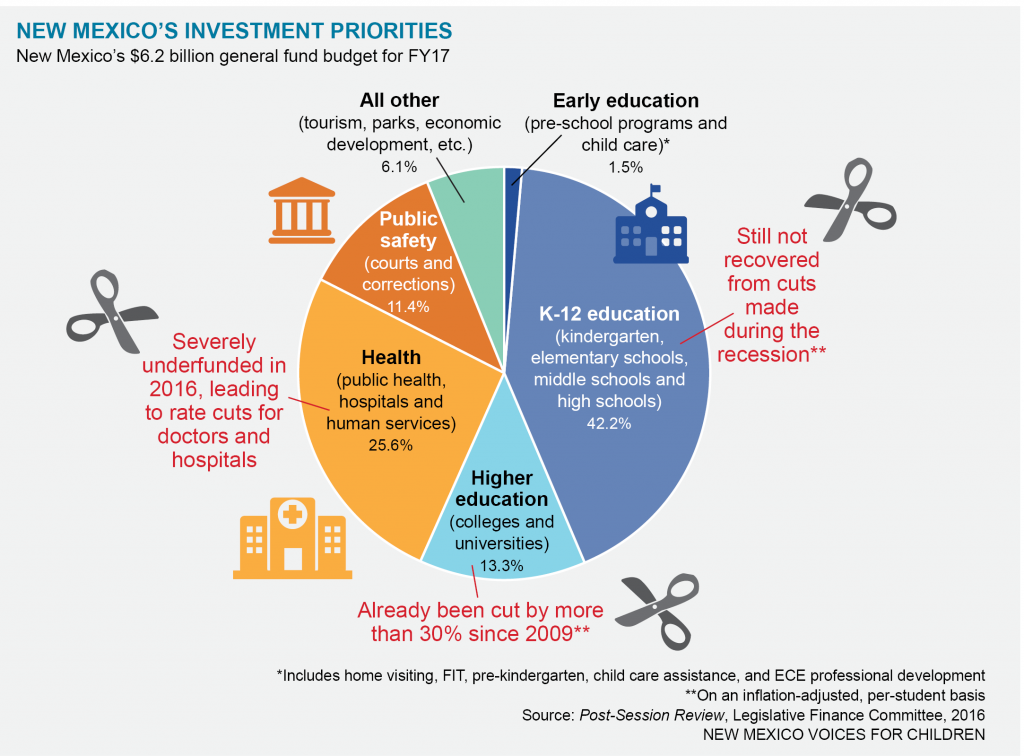

A Guide To New Mexico S Tax System New Mexico Voices For Children

A Blueprint For A State In The Red New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Sales Tax Guide And Calculator 2022 Taxjar

What You Should Know About Changes To Nm Tax Reporting Youtube

Nmsu Importance Of The New Mexico Dairy Industry

New Mexico Lawmakers Ok Crime Bill 500m In Tax Rebates New Mexico News Us News

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

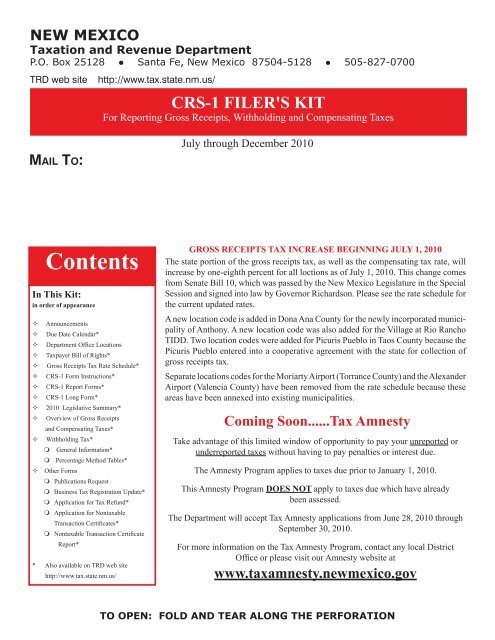

Filers Kit Taxation And Revenue Department State Of New Mexico

Lawmakers Taking Cautious Approach To Plan To Cut Grt Albuquerque Journal

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children